- Bella Vista: 02 9688 1144

Services

How can we help you?

To use a motoring analogy, we believe that your financial goals could be reached by using one gear, but it may not be as efficient as using several to improve overall performance.

We provide financial advisory services (independently or interdependently) in each of these important areas.

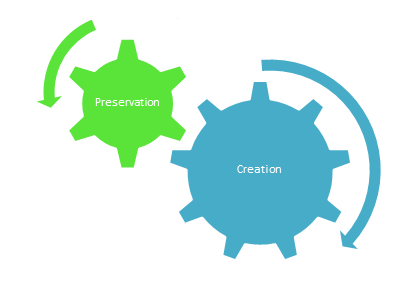

Wealth Creation

Advice on wealth creation is not about what and where – it’s about HOW and WHY.

Wealth can be created as simply as: paying off debt quicker; by holding assets in a different structure; or with time.

We understand clients each have their own unique needs – and we are well versed in recommending, implementing and reviewing strategies to meet those needs.

We appreciate that young adults may be focused on saving for a deposit to buy their first home, and seeking finance to complete the purchase.

We know that families may be focused on paying off debt quicker, and providing the best care and opportunities for their children.

We are aware that where you are thinking more about retirement, it is important to know what your resources will be when work is finished, and the longevity of those resources.

We know that retirees should focus on skiing and other worthwhile pursuits.

Our advice is tailored to a client’s stage in life. And we believe that as we are not owned (partially or wholly) by a financial institution, bank or life insurance company, we are ideally placed to provide advice that is in your best interests.

Wealth Protection

One of our main principles is “protect what you have worked hard to gain”. We advise our clients on the best way to manage the various risks that may present themselves over time. Risks that may affect retirement savings, financial goals, or standards of living.

Wealth protection is not just about buying an insurance policy – though this is an efficient way of managing some financial risks.

Wealth protection is about:

- ensuring a retiree has sufficient resources over their retirement; or

- investors deciding not to enter into a particular investment; or

- diversifying a portfolio of assets not to have “all the eggs in the one basket”.

Advice on wealth protection is simple: work out what risks may affect you; what it will cost should a risk eventuate; and deciding whether to avoid the risk, transfer the risk, or accept the risk and self-insure.

We will help you understand this crucial area of financial planning, and to make the best decision for you.

Why Us?

Our clients become (and remain) advocates for us for the following reasons:

Knowledge

Our financial advisers hold diploma, undergraduate and post-graduate qualifications in financial planning and related disciplines – including: accounting; finance; and investment.

Experience

We have over 35 years combined experience in the financial planning industry and over 60 years combined in the banking and financial services industry.

Research

Where our advice includes the recommendation of financial products to clients, the recommendations are based on extensive research conducted by independent third party providers – research providers free of conflicts of interest.

Stability

Moneytax Financial Planning has its origins dating back to 1989.

Fair

We believe all Australians deserve appropriate financial planning advice – not just a select group.

Comprehensive

Through MFP and its related entities, we offer our clients a wide range of financial services, including: accounting and taxation; and business advisory.